When you’re facing a financial emergency and banks say no, NetCredit may say yes. This online lender offers fast access to personal loans and lines of credit, even for borrowers with bad credit or limited credit history.

But the convenience comes at a high cost, with APR rates that can reach up to 155 percent. In this review, you’ll learn how NetCredit personal loans work, who qualifies, and how the total cost compares to other lenders.

If you’re weighing short-term funding against long-term affordability, this guide will help you decide whether NetCredit is the right choice.

[reviews2024 id=146951]

What is NetCredit?

NetCredit is a Chicago-based online lender launched in 2012 and owned by Enova International Inc. (NYSE: ENVA). It specializes in subprime personal loans and lines of credit, targeting borrowers who may not qualify for traditional bank financing due to poor or limited credit history.

- Founded: 2012

- Parent Company: Enova International

- Credit Bureaus Reported To: TransUnion, Experian, and Equifax (depending on loan terms)

NetCredit operates in over 35 states but does not serve residents in states like New York, North Carolina, and Pennsylvania. Loan products and terms vary based on your location and NetCredit’s partner banks.

NetCredit loan options and eligibility

NetCredit offers two core financial products: personal loans and lines of credit. These are designed for borrowers with poor, fair, or limited credit histories who may not qualify for traditional bank loans.

1. Personal loans

NetCredit’s installment loans provide a lump sum of money that is repaid over time in fixed monthly payments. They’re ideal for covering emergency expenses, medical bills, or consolidating high-interest debt.

- Loan amounts: $1,000 to $10,000

- Terms: 6 to 60 months

- APR: 34 to 155 percent (varies by state and credit profile)

- Interest: Fixed-rate

- Fees: No prepayment penalties, though origination fees may apply in some states

- Collateral: Not required

2. Line of credit

This revolving credit product works more like a credit card, allowing you to withdraw funds as needed up to your approved limit. It offers flexibility for ongoing or unpredictable expenses like car repairs or utility bills.

- Credit limits: Varies by borrower and state, up to $10,000

- APR: Varies; typically includes monthly fees

- Repayment: Pay only on the amount borrowed

- Fees: May include cash advance and monthly statement fees

[reviews2024 id=170497]

Who qualifies for a NetCredit loan?

NetCredit uses a proprietary underwriting model that looks beyond your credit score. While a credit history check is required, many applicants with poor or limited credit are approved based on their overall financial profile.

To qualify, you must:

- Be at least 18 years old (19 in Alabama and Delaware, 21 in Mississippi)

- Live in a state where NetCredit operates

- Have a valid personal checking account

- Provide a verifiable source of income

- Have a working email address

NetCredit does not publish a minimum credit score requirement. You can check your eligibility through a soft credit inquiry that does not affect your score. Understanding how credit scores impact your ability to qualify for financing can help you avoid costly offers and improve your chances of approval through responsible credit-building strategies.

How to apply with NetCredit

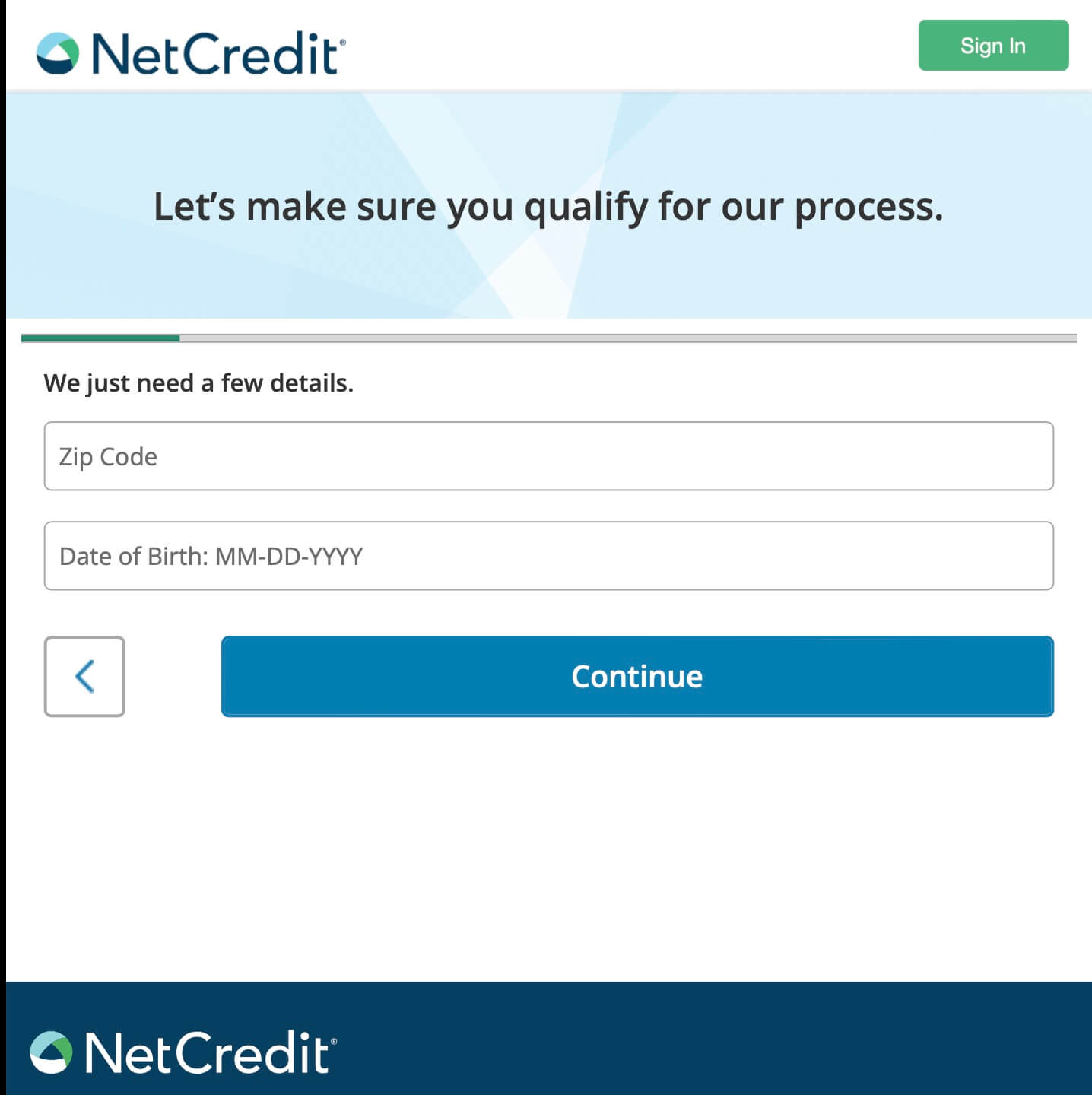

The entire application process is online and typically takes under 10 minutes:

- Prequalify: Use NetCredit’s My ScoreSaver™ tool to see loan options without affecting your credit.

- Customize: Adjust your offer using the RightFit Tool™ to find a term and payment that works for your budget.

- Accept: If approved, sign the contract (this triggers a hard credit inquiry), and receive funds as soon as the next business day.

[reviews2024 id=146888]

NetCredit pricing and fees

NetCredit’s interest rates are high—even compared to other bad credit lenders. APRs vary by location and borrower profile but generally range from 34 percent to 155 percent.

Typical fees include:

- Origination fees: Applied in some states and deducted from loan amount

- Late payment fees: Vary by state (waived for loans after March 2025)

- Cash advance fees (lines of credit): Around 10 percent per withdrawal

- Statement balance fees: Applied monthly on active line of credit balances

There are no application fees, no prepayment penalties, and no non-sufficient funds (NSF) charges.

Example: A $4,000 loan at 80 percent APR for 36 months may cost you over $12,000 in total payments—more than triple the original loan.

What customers say about NetCredit

Here’s a breakdown of NetCredit’s reputation across major consumer review platforms:

Trustpilot reviews

Rating: ★ 4.8 out of 5 stars (30,800+ reviews) Sentiment: Strongly positive overall

Trustpilot reviewers generally express high satisfaction with NetCredit, praising the ease of the application process, quick approvals, and fast funding. Many note that the loan terms were clearly disclosed and the company didn’t surprise them with hidden fees.

“The entire process was easy and stress-free. I appreciated the transparency, and the funds were deposited faster than I expected. Highly recommend if you’re in a bind.” — Karlee Leek, July 2025

NetCredit has an “Excellent” TrustScore and actively responds to reviews—replying to 95 percent of negative comments, typically within 48 hours. Several customers said they were repeat borrowers due to the consistent service.

However, some 1-star reviews point to miscommunication during approval steps, delayed verifications, or confusion around statement fees. Still, these make up less than 3 percent of all reviews.

Better Business Bureau (BBB) reviews

Rating: ★ 1.05 out of 5 stars (80+ reviews) Accreditation: Not accredited Complaints filed: 378 in the last 3 years BBB Rating: B

In stark contrast to Trustpilot, NetCredit’s reviews on the BBB site are overwhelmingly negative. Complaints frequently mention:

- Being charged large fees with little to no reduction in loan principal

- Misleading or incorrect payment due dates on the portal

- Issues with identity verification and communication failures

- Claims of predatory behavior toward financially vulnerable borrowers

“I’ve paid over $800 on my credit line and only reduced the principal by $50. They reported a missed payment even before the due date passed.” — Kathryn S., June 2025

Several reviewers also cited serious customer service issues, including being bounced between representatives and denied supervisor access. A few reports mentioned suspected fraud or data misuse, with poor internal support from NetCredit in resolving these cases.

Credit Karma reviews

Rating: ★ 3.1 out of 5 stars (996 reviews) Sentiment: Mixed to negative

On Credit Karma, users present a more nuanced view. While some borrowers appreciate the fast approvals and lack of credit score barriers, others caution against the long-term costs associated with NetCredit’s high APRs and frequent fees.

Positive reviewers often use phrases like “lifesaver” and “fast and easy” but emphasize that these loans should only be used short term:

“I knew what I was getting into. My APR was 64%, but I paid it all back in three months. It worked for my emergency, and I had no issues.” — Credit Karma member, June 2024

Critical reviews mention:

- Feeling trapped in debt even after making payments for months

- Denials after soft-pull prequalification

- Poor communication from support

- Loan amounts being less than advertised due to upfront deductions

Credit Karma reviewers consistently warn against using NetCredit for long-term borrowing.

Reddit reviews

Sentiment: Overwhelmingly negative in subs like r/povertyfinance

On Reddit, particularly in threads within r/povertyfinance, NetCredit is frequently described as predatory and exploitative. Most users report high levels of frustration with the loan structure—especially the monthly “statement balance” fees, which often exceed the amount applied to the actual loan principal.

“I took out $2,900, received $2,600 after fees, paid back $2,328 in 6 months—and still owed $2,473. This company is predatory. I had to file bankruptcy.” — u/original-bean, June 2025

Common Reddit criticisms include:

- Balance statement fees that make it nearly impossible to reduce the principal

- Payment structures that seem designed to keep borrowers in long-term repayment

- Hard credit pulls following soft approval

- Lack of transparency in how interest is calculated

Several users shared that they were approved and then later denied, even after funds were sent, leading to stress and overdraft risks.

That said, some Redditors noted that NetCredit works with debt management programs like GreenPath, where interest can be waived and repayment structured over 12 months.

NetCredit outcomes and success benchmarks

NetCredit does not publicly disclose approval rates or savings outcomes. Based on third-party reviews and consumer feedback, qualified borrowers often receive funding within one to three business days, depending on when the loan agreement is signed.

NetCredit reports to at least two major credit bureaus (usually Experian and TransUnion, and in some cases Equifax). On-time payments may help build your credit; missed payments will harm it. Before committing to high-interest borrowing, consider how debt impacts your long-term financial health, especially when lower-cost options exist.

NetCredit pros and cons

NetCredit offers speed and accessibility, but at a cost. If you’re weighing whether the trade-offs are worth it, here’s a quick breakdown of the main advantages and disadvantages to consider.

Pros

- Fast funding (as soon as next business day)

- No prepayment penalties

- Soft credit check for prequalification

- Available to borrowers with bad or no credit

- Reports payment history to credit bureaus

Cons

- APRs up to 155 percent

- Not available in every state

- Potential origination and cash advance fees

- No co-signers allowed

- Long-term borrowing is expensive

[reviews2024 id=149642]

Who NetCredit is best for, and who should avoid it

NetCredit loans are not one-size-fits-all. Depending on your credit profile, financial needs, and ability to repay quickly, this lender may be a helpful short-term solution—or a costly mistake. Here’s a quick guide to help you decide.

Best for:

- Borrowers with poor or no credit history

- People facing short-term emergencies (car repair, eviction, medical bill)

- Those who plan to repay quickly to minimize interest

Not recommended for:

- Borrowers with good or excellent credit

- Anyone looking for a long-term loan

- People in states where NetCredit does not operate

[reviews2024 id=146960]

Final verdict

NetCredit can be a lifesaver in a financial emergency, but it’s one of the most expensive loan options on the market. If you’re considering NetCredit, be sure to read the fine print, understand the fees, and make a plan to pay it off as quickly as possible.

Borrowers with credit scores above 650 should look elsewhere for better rates and lower costs. But if traditional banks have turned you down and time is running out, NetCredit may be a viable—though costly—solution.

Apply with caution. Borrow intentionally. Never borrow more than you can afford to repay.

[reviews2024 id=146917]

Frequently asked questions

1. Is NetCredit a real credit card?

No, NetCredit is not a credit card. It offers personal loans and a line of credit to borrowers who may not qualify with traditional lenders or banks. The NetCredit line of credit functions similarly to a card because you can borrow as needed up to your approved loan amount, but it is a separate financial product, not a revolving credit card issued by Visa or Mastercard. These products are designed for individuals with bad credit or limited access to traditional credit options.

2. How does the NetCredit line of credit work?

The NetCredit line of credit gives borrowers access to flexible funds, which they can draw from at any time up to a set credit limit. You only pay interest on the amount you actually borrow. Additional fees, such as monthly statement fees and cash advance charges, may apply. Your available credit replenishes as you make payments. This product may be especially helpful for managing recurring expenses like rent or bills. As with all NetCredit loans, your payment history may be reported to credit bureaus, which can affect your credit scores positively or negatively.

3. How long does it take NetCredit to deposit funds?

Once your loan contract is signed and approved, funds from a NetCredit personal loan are typically deposited into your bank account by the next business day. In some cases, if you complete your application and accept the offer early in the morning (before 11 a.m. Central Time), you could receive your money the same business day. However, exact deposit timing may vary depending on your bank’s processing schedule. NetCredit is known for fast funding, which is one reason why many borrowers prefer it when time-sensitive expenses arise.

4. Does NetCredit report to credit bureaus?

Yes. NetCredit reports your payment history to at least two major credit bureaus, including Experian and TransUnion, and in some cases Equifax. This means your credit score can be impacted based on how consistently you make monthly payments. If you pay on time, it can improve your overall creditworthiness, especially for those with bad credit. Missed or late payments may negatively affect your score and could lead to collections. Always review your due dates and loan terms, and make sure you are eligible before you sign the contract.

5. Is NetCredit legitimate or a scam?

NetCredit is a legitimate lender backed by Enova International Inc, a publicly traded company listed on the New York Stock Exchange (NYSE: ENVA). Enova also operates several other consumer credit brands. While NetCredit loans tend to have higher APR rates compared to traditional lenders, the company is licensed and regulated in most U.S. states. These loans are intended for individuals who may not qualify elsewhere due to low credit scores or limited income. Visit NetCredit’s official website to verify eligibility, understand the total cost of the loan, and read a full review before applying. Keep in mind that approval is not guaranteed, even for first-time borrowers, as the decision considers factors like income, bank account activity, and overall credit profile.